Egypt’s energy bill, already a whopping $17 billion, is probably much higher than official figures suggest.

The country is losing billions in petrodollars because it isn’t taking advantage of the international market where oil can be sold at much higher prices, nor is it closing up channels that breed corruption and allow hidden subsidy costs to take hold.

Officially, energy subsidies account for 20% of Egypt’s budget, costing the government $17 billion every year, but it is likely the government actually spends much more on subsidies every year.

1. Missing out on opportunity cost

If the government would account for the opportunity costs (sometimes also referred to as economic costs) of energy subsidies, it’s subsidy bill would be at least 50% higher than the official figure.

This is the money the Egyptian government loses by not selling fuel at the international market price, but at far cheaper rates.

That means the state-owned oil company, the Egyptian General Petroleum Corporation, provides energy at a cheaper price for the domestic market, when it could be taking advantage of the lucrative international oil market.

The difference between the profit that the EGPC could have made from selling the fuel internationally and the oil it sells domestically at a subsidised price is the “opportunity cost”.

In order to capture this opportunity costs, economists use the so-called price gap approach.

2. Lending between ministries has opened up channel for corruption and hidden subsidy costs

The government has made it almost impossible to track the true costs of energy subsidies.

That’s because of poorly recorded budgets and unnecessarily complex bureaucracy between the oil, electricity and finance ministry.

Samir Radwan, a former Egyptian finance minister explained how this internal bureaucracy works:

“When the EGPC provides fuel to the Ministry of Electricity, its sells it at the subsidised price. The Ministry of Electricity, in turn, collects revenues from electricity sales and pays them to the Ministry of Finance which issues a bond to the Ministry of Electricity.

But the subsidies are recorded as an expenditure at EGPC. It would be more correct, however, if EGPC would sell fuel at the international market price to other entities and then account for the subsidies as a loss.”

Intra-governmental funding has made it even more difficult to track how much subsidies are costing the nation and an “amazing labyrinth of connections between different ministries and different entities of the government,” Radwan says.

This only serves to undermine official figures.

But more worrying still is that the convoluted internal financing mechanism is masking an accumulation of intra-governmental debt. The Ministry of Electricity not only owes money to the EGPC and the Ministry of Finance (according to estimates, the Ministry of Electricity pays about 200 million Egyptian pounds a month to the EGPC), but is also owed funds and debts by other ministries and entities.

The question now is: how will the government undertake any energy subsidy reform, if it is not even able to track its own subsidy records?

Story originally published in Rebel Economy

This guest post is by Stefanie Heerwig, a freelance journalist and researcher at Openoil, a Berlin-based energy consultancy and publishing house

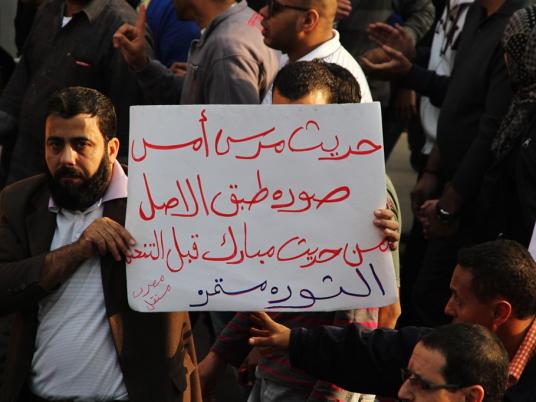

Farah Halime is the editor of Rebel Economy, a blog focused on how Middle East economies are rebuilding after the Arab Spring